|

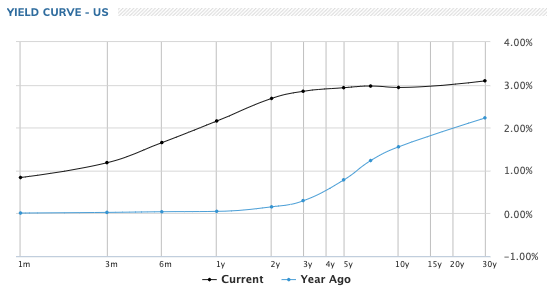

Today we see US Treasury Yields up across the board, and a flattening yield curve.

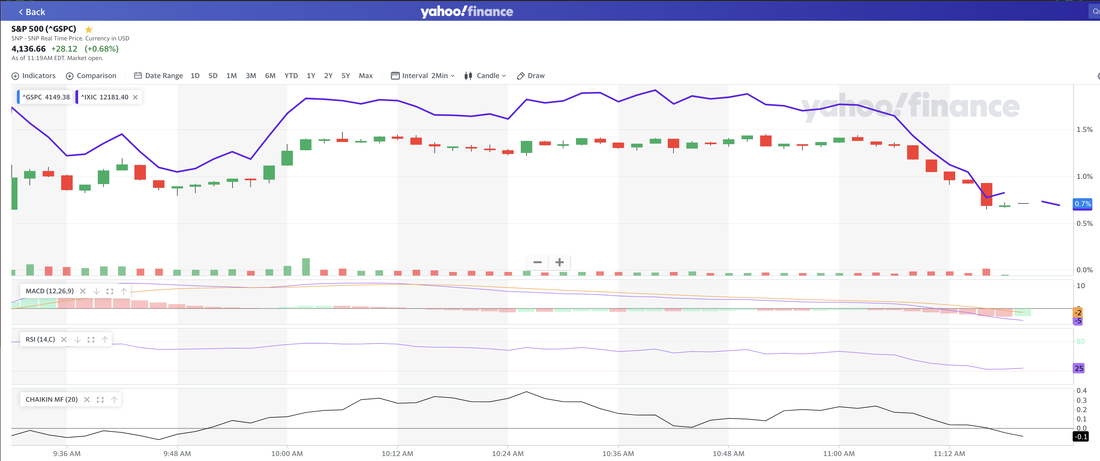

1 month bills, 10 year notes and 30 year bond yields are all up today. And yet, the US equity indices are also all up today. Since we starting writing this post the S&P 500 Index and NASDAQ Composite 100 both fell sharply over the past 5 - 10 minutes. I guess we are not the only ones watching... Normally, rising interest rates means equities fall. Unless, a second order effect is taking place where higher yields are expected to reduce inflation, which is good for stocks. This seems far-fetched to us and stretches reality. We think today is an anomaly and either US equity returns will fade into the close (meaning equities fall), or bond yields will fade into the close (and bonds prices will increase). We also see three stocks rising (against deteriorating fundamental valuations): $MULN Mullen Automotive $VIEW View Inc. $AVYA Avaya Holdings Corp. We are currently short Avaya, and plan to go short the other two in the near future. Another stock we have not researched is also up: $PEGY Pineapple Energy Inc. IMO: PEGY going to run. Somebody (or a group) traded 2.5M shares and did not move the stock price. My guess is this buy order was submitted before and the market maker took the stock price up to clear the trade. PEGY has a 5.6M share float (so this trade was 45% of the float). 7.44M shares outstanding, so this is 33.6% of the total outstanding shares. Unless we see an SEC filing for a take-over, I would guess this is a group purchase to run the stock. Good luck today. GLTA!

0 Comments

By Jeffrey Cohen, Investment Advisor Representative

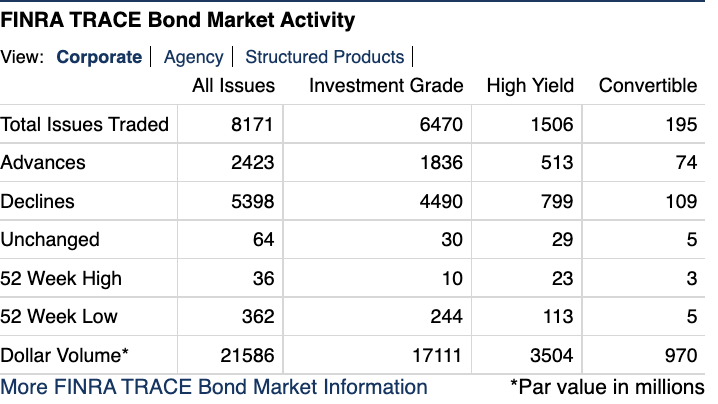

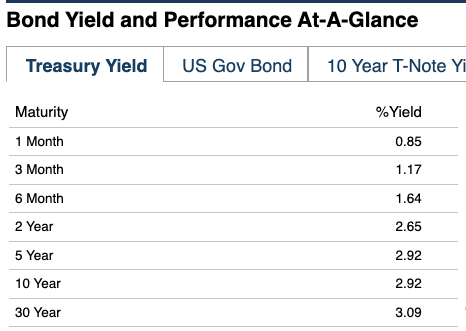

This morning the US equity markets are set to open higher by 1% or more, but are weakening as we write this BLOG. Silver (+2%), oil (now flat) and gasoline (down 1%), natural gas (+5%) and copper (-1%) are sending us a mixed message. VIX at 25.40 means the market is starting to settle down. Not sure if this is Summer Doldrums, an increase in liquidity and confidence, or something larger. Food commodities are up today, with Wheat up 3.5%. USD slightly weaker. Euro/Dollar at 1.0730 and 100 JPY / Dollar = 0.7655 show slight strengthening against the USD, but not by much, and these are weak levels. The S&P 500 e-mini June 2022 futures have been trading higher all morning. We are thinking these are the best way to hedge our CQNS UP portfolio, as long as the contract sizes are not too large. One contract trades for about $207,600k, and provides 50x the S&P 500 index movement. There is a micro e-mini future which trades similarly, and trades for ~$20,000 per contract. Not sure if it has the same liquidity, but this allows for hedging of much smaller portfolios. Crypto is much higher today. Bitcoin / USD = $31375. Last night it was at $31,111. This will support crypto stocks like $MARA $RIOT $SI $BTBT $HUT $CLSK $CAN $SLNH and likely the trading applications like $COIN and $HOOD. This is support for a risk asset that is not equities. Fixed Income Fixed Income: Long Bond at 138.19, 10 year at 118.56 are about the same as Friday. This is confirmed by looking at yields. 30-year UST Bonds yielding 3.09%, 10-year & 5-year UST Notes yielding 2.92%. The 1-month bill is yielding 0.85%, which is up and starts to push savings account and money market interest rates higher. Savers will start to see more attractive yields, which could pull money from equities more quickly (not just a risk-off move, but also an income generator). This is not great for banks, who may still be borrowing short and lending long. That yield is evaporating, especially when the risk-free rate for financial institutions is 0.08% at the FRB Reverse Repo window. Banks are taking advantage of this 'window' for more of their excess deposits and reserves, up to $2.03T on June 3rd. The good news is that quantitative tightening has the money parked overnight, and so the first ~$1T of liquidity pulled from the market can, in theory, come from excess reserves. This will take some finesse from the FRB. To me, it means we have the possibility of a pain-free tightening at least for the first $1 Trillion. We shared a Goldman Sachs note on Friday or Saturday that indicated high yield corporate debt has a great last week. Many issues were priced and demand was strong. They indicated this week would be weaker, with only one issue to be priced. We saw strengthening in the downtrodden stocks we follow, which is confirmation to this point. Corporate bonds were down on Friday. The New Low : New High ratio hit 10:1, which shows weaker issues were pushed further lower. The Decline : Advance ratio was 5.4 / 2.4 or 2.25. Investment grade issues suffered the worst, with a 24:1 new low to high ratio. Watch out for falling knives in this market. Final point: the pre-market movement of four industries / proprietary indices we follow are all up significantly. This points to early morning money moving into momentum-based sectors. This supports the indices to open higher. Now, we don't always listen 100% to pre-market moves, as they are typically on lower volume and cost significantly more to trade (spreads can be 10x to 100x larger), but on large, consistent moves we do take notice. Money wants to be in-place before the market opens. These 4 industries are all up broadly and significantly in pre-market. Money Managers Specialty Retail & Furniture Chips and Semiconductors Crypto and Physical Miners Trucking & Transportation is also up (about half the issues unchanged, and half up) Final point. We read anecdotally that new car retail sales were down in May. We want to follow up on that information for tomorrow's video. Do we have any stocks (potential runners) we follow to discuss? $MULN (The only significant and violent pre-market action is here) $VIEW $AUTO $VRM $COIN $KOS $GBR $MTMT and many more... Good luck in the markets today. Jeff By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Here is what we saw this morning: US Equity Futures were RED, indicating a lower open. SPY QQQ IWM. We checked and there was a big buy pre-market that took prices higher for just a minute or two, but they continued to fall. Many of our leading industry indicators were down pre-market as well. Semiconductors, Money Managers, Crypto and Mining, Retail (specialty). Trucking and Transport was mixed. Our 'DOWN' stocks and possible short squeeze 'runners' were generally lower, except for $SIGA and $MULN which were higher in pre-market. Our CQNS UP Run stocks were lower or unchanged in pre-market. This is a sign of institutional 'bets' being made as these stocks require deep analytics to find and put together into portfolios. These are your risk vs. return optimized portfolio bets (best and larger portfolios) $MULN is up pre-market. Mullen Automotive is in default on some loans, and has ~$3M in delinquent payroll taxes that puts most of their assets under an IRS/State tax lien, even before their senior secured debt. Source: 10-Q. The signs of lower liquidity are present in the market. We shared charts showing the main US equity indices are hitting higher highs and lower lows (as a multiple of SPY 1.25%, QQQ 1.50% and IWM 1.75%). This is one potential outcome, and not an absolute sign, of liquidity. Global markets were mixed. Mainland China and Japan were higher, while Hong Kong was lower. Europe was down slightly. Gasoline was up to $4.21, then $4.22 per gallon wholesale. This is very high, and causes us concern over specialty retail and retail in general. We spoke at length on this topic. Most commodities were about the same, but Lumber (random lengths, used for houses) has been falling sharply lately. Also, copper recovered from the 'stock market crash' a few weeks ago. This was surprising to us, as copper had climbed to $4.70 as a support level, then fall to 4.10, and was up above $4.50 this morning. This means that copper was set to resume its rise, and either reflect a stronger economy, or just cost the consumer more in all the electronics they purchase. Copper is a staple, or important input for an industrial economy. Watching the price rise 10% in a month is troubling for inflation watchers. US Treasury Bonds and Notes yields were up. The 30-year Bond trades at $137.97 (yield 3.08%) and the 10-year Note trades $118.50 (yield 2.91%). This matters because investors are losing money on their bond holdings (and mutual funds). This also will impact residential mortgages, which could easily see 6% (3% base + 0.5% default + 2.5% margin). This will hurt home improvement retail, remodeling, appliances, home building, lumber (already falling), banks and mortgage companies, and reduce construction labor demand. This also hurts those who hold the long bond in their investments. We suggested to keep track of the absolute price of the 30-year bond: $137.97 during future videos. Corporate Bonds: Sorry, cannot remember what we discussed here. Agency Debt / MBS: Issues were about 1:1 advancers to decliners, so pretty flat. However, we see 4.5 : 1 new lows to new highs in issues, so there must be pockets of weakness in the mortgage market. We looked at potential runners or short squeeze candidates. VIEW down MULN up on high volume *** BBAI down BSQR no volume SIGA up BBIG up a little BKKT down AVYA low volume US dollar was stronger, and this continues to weigh on US corporate profits for global firms. EuroDollar = 107.28 Yen/Dollar 130.292, or ~ 0.77 $RVP Retractable Technologies Inc. makes safety syringes and has government funding to expand domestic (US) capacity for manufacturing. That capacity is likely to sit idle now. However, we like this company. Not sure we like the stock at this price, but we like the company. We also like $CLF and $FLXS but again not sure on a stock price target. We like the companies. After the video was made, we listened to President Biden speak to the American people. He said something important about the economy. He said that we will run a smaller US Federal deficit in 2022 than 2021 by $1.7T. Most of the year is over, but if this continues next year, it is deflationary. Another sign of extra money with no place to invest it is the Overnight Reverse Repurchase market / window at the FED. Link: https://fred.stlouisfed.org/series/RRPONTSYD This shows that $1.99T is being parked overnight at the Fed. This is one reason why inflation is 'only' 8.3% and not higher. If this $2T had someplace to go (loan demand), that money would be chasing goods, services and assets along with the other ~$26T in M2 that already is. We also checked the COVID numbers through June 1, 2022 in the US. Cases are up and rising, but not nearly as high as in January 2022. Deaths also continue to rise, and surpassed 300 / 100k people in total. Daily cases are approaching what looks like 200k, and we worry this is bad for the 'Main Street' economy (along with gasoline prices). We checked with our friends at the Bureau of Labor Statistics, BLS.GOV, and inflation is still posted for April, which was 8.3% overall, and 30% for gasoline. The problem is that gasoline inflation has been 30% for 2+ years, which has a compounding effect (and why gas is $4.22 this morning, wholesale). Bitcoin / USD was lower today, down to $29,500. This brought down the bitcoin miners as well. We discussed the 1-year performance of the main US equity indices (excluding dividends ~ 1%). Actual SPY return = 0.61% Actual IWM return = -16.70% Actual QQQ return = -5.27% Very distracting but listening to President Biden's speech today. He said an important thing, that the US Federal Government is on track to pay down debt, this quarter, for the first time in recent history. This is inflationary, but probably not big numbers yet. (you give me bonds, I give you cash). He also said the US Federal Deficit is on track to shrink $1.7T this year (vs. last year). This is deflationary (brings down inflation), because you give me more money in taxes, and I give you less money in payments for good & services, or I make fewer payments). So, in the inflation-fighting scorecard, this is $1.7T to the good. We saw a little in the Treasury General Account (TGA) in an earlier video of about $12B, so we saw evidence of this. Video available here: https://www.whitehouse.gov/live/ Good luck in the markets today.

We worked hard today not to veer off course and stick to key economic and financial data. After typing this up, I realize that this is probably too much content for one video, but important to get the big picture. Hope you find it helpful. GLTA Jeffrey Cohen By Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. Initially posted at market open, updated 31 minutes into the trading day. #stocks #stockmarket #invest #premarket #avaya #valuation

The stock market and stocks premarket are showing Summer behaviors. We do see some news driving two individual stocks. Hewlett Packard Enterprise $HPE and Microsoft $MSFT are both down today. We will listen to the HPE earnings call this morning. Today, June 2, 2022 we will look at stock market action. We will check in on our previous short squeeze candidates and look at the overall financial big picture. This morning we also did a deep dive valuation of Avaya stocks AVYA $AVYA from their most recent 10-Q and market trading of their two bonds. We show you the equity market value of Avaya, the debt market value, and review their business performance. e demonstrated that fixed income, or bonds, were lower yesterday in both the agency or mortgage backed securities markets and in Corporate bonds. We are a little worried that there were 9x more new lows than new highs in the corporate market. The increase in yields of MBS could be due to Federal Reserve Bank quantitative tightening QT #beginning #qt yesterday. We also looked at the major indices, $SPY $QQQ $IWM and the VIX. These are in a downward pattern after years of rising. We don't know, nor can we tell with any certainty, whether the market will continue to fall or rise. What we do know is that it is more risky today to be long stocks. There was little news today. 1) Russia is mad at the US for providing missiles to Ukraine. 2) Microsoft warned of lower revenue and profit. In terms of stocks to short, or potential short squeezes, our analysis earlier this week is already out of date. The runners yesterday are slow today, or down. $BSQR or Bsquare is up pre-market in what is probably a runner. However, it already ran pre-market, so it is already too late. We deleted the video on youtube. It was found to be too aggressive by the content provider. Disclosure: We are now short this stock (June 2, 2022 at 11:10am ET). This is not investment advice, although we are investment advisors. Best regards, Jeff

By: Jeffrey Cohen, Investment Advisor Representative US Advanced Computing Infrastructure, Inc. We identified 12 stock tickers that might have been working towards a short squeeze, or at least be 'in play' stocks with large expected price swings. Here is the list: $VIEW $MULN $INDO $BKSY $AMC $SIGA $BBIG $VRM $SAVA $BRDS $BBAI $MKD This morning we review the list of stocks that might run today, at least a few of them, and see how they were behaving pre-market. General situation with these stocks: - Poor fundamental performance - Financial trouble, possible liquidation risk Overall context is that the stock market is up from the lows of a week ago. Yesterday it was lower. The corporate bond market was also weaker yesterday. We look for movement pre-market as a good indicator. INDO Indonesia Energy Corporation Limited They own two blocks in Indonesia. No options (on MarketWatch). Zero borrow (on shortables.com). SEC EDGAR SEARCH - you can look for INDO and pull up their annual report (foreign registration). This is a long report. One block produces about 5,000 barrels per month (at a cost of ~$60/barrel) and the other is under development. Looks like a strong candidate for a short squeeze. $BBIG Vinco Ventures Traded 350k shares PM BBAI BigBair.ai Not many shares traded, price down to $5.28 pre-market (from a recent $10 level). No economic profit, government contractor. MKD Molecular Data Trying to stay above $1.00. This stock can move, has social media support. AMC AMC Entertainment Holdings Inc. Cl A This stock trades actively in pre-market. 1.7m shares. Moved up and down $1.00 during pre-market. Volatility play like MARA? SEC EDGAR SEARCH. 500M+ shares x $13/share = $6.5B market cap. Loses money, even when all the movie theaters are open. Make money on food and beverage (75% margin), but lose on the theaters. They bought stocks in a gold and silver miner. Negative net worth (-$4.5B tangible net worth, ~$2B if you include intangible assets). They spend money in their operations every quarter, looks like about 1/3 of a billion per quarter. Looks like they have to borrow or dilute the stock to stay in business. Again, actively traded pre-market. BRDS Bird Global Inc. Not very active pre-market. Trading at $0.79, and was a SPAC at $10.00 earlier this year. They are an environmentally friendly company that makes scooters and bicycles, sells them at cost, then makes money when people buy and operate their system. They share revenue, or get a fee when someone rents a scooter or bike due to their software and operating framework. This company loses money, and likely cannot make money for a while. The buyer / client buys the scooters and bikes and operates the system. Stock is down 92.5% from the SPACC price. Stock is not moving. VIEW View Inc. SEC EDGAR SEARCH Smart building platform, that likely needs significant of capital to complete their product development. Likely should not be a public company, but more of a private equity play. Earnings release. No 10-Q. Revenue is great, up to $74M. Cost was $195M, so they lost ~$120M. They expect 2022 revenue at $100M to $110M, which does not seem to be alot. GOING CONCERN warning in the next SEC filing. Not sure how they survive. BTW, stock is trading higher today at $1.61 at the time of writing (1014 ET). VRM Vroom Inc. Traded 125k shares pre-market. Not moving alot today. MULN Mullen Automotive. This is a development stage electric vehicle (EV) manufacturer. Traded 9.3M shares pre-market, up $0.10 pre-market. SEC EDGAR SEARCH This is a very interesting recent 10-Q. This is the focused firm, the EV spinoff. The revised 10-Q had some corrections, they are not in default on one of their loans. They have assets, and $55M in shareholder equity. Profitability: They lost $69M in the last 6 months, cash basis they lost $25M. They are issuing shares of stock to vendors and employees ($24M + $3M = $27M). They raised $12M in debt They sold and raised $40.xM in common stock. They issued a new preferred class of stock for $64M, which is expect to pay a dividend. They paid back $15M in debt. Net-net, if you spend $25M per quarter, you have to raise money constantly. Developmental stage company. They used $27M in cash for 6 months, and they have ~$40M in working capital. This gives them about 9 months of runway. They think this money will keep them going. Their debt looks odd to us. Matured notes, promissory notes, real estate notes, and other types of loans. They borrow money from third parties and officers of the company for relatively short periods of time, less than 3 years. Interest rates are up to 28% on the promissory notes. This looks anomalous. They paid down many small loans. They also have terminated a development relationship with Linghong Bao (not sure of spelling) due to force majeure due to COVID. They have an expensively structured equity issuance agreement with Raymond James. They never paid the $50k cash retainer. They also lost a lawsuit with IBM and owe them ~$5.6M dollars. They owe back taxes to the IRS and California Employment Development Corp. The IRS has a lien on effectively all of their assets. It's like a bad movie, and yet it is up $0.11 PM. Cannot short it, zero borrow. Yes, there are options, but the puts price the company as low as $1.25 in 2 days down through $1.05, then down to $0.80, then $0.55 in 2024. $1.50 puts are very expensive, so you likely have to short the stock and 'ride it out.' SAVA Cassava Sciences Inc. This is a biotech stock that traded at $1.25, then reached for $100, and is now back to ~$30. They do have current assets (cash) and very few liabilities. They likely can operate for a long time. Company worth $237M in shareholder equity. The market cap is $1.23B, so there is an extra $1B in market cap. Do we know where that comes from? Was there a drug development or progress made? We don't know, and someone would need to dig into it. Is the candidate drug pipeline worth one billion US dollars. BKSY Black Sky: down this morning Down $0.25 pre-market. Pre-market 1.1M shares. SEC EDGAR SEARCH Analysis of the company. $135M in cash, down from $165M. Assets are primarily in satellite work and in fixed assets (satellites). They have shareholder equity of $166M. Market Cap is $394M. Revenue went up from $7M to $14M YtY for the quarter. Cost rose to $17M. However, SGA cost almost tripled from $8M to $24M for the quarter. Very high costs. They lost $20M in the quarter. They used up cash. They paid $10M in salaries in stock. No financing this quarter, as they did it last year. Spent down their cash. They were a SPAC, with 12 satellites in operation. They lose money, and likely have to raise money. It popped from $1.18 to $3.27, so why did that happen? VRM Vroom Starting a leasing company, captive, despite their exceptionally high cost of debt. They have a Texas-based car dealer and software to enable car buying and selling. This stock has liquidity issues. SIGA SIGA Technologies: Down this morning Possible Money Pox cure. Volatile stock. Fell to $10.79 this morning pre-market. It was a $8 / $9 stock before the rise. Be careful with these stocks. They are risky. Deck chairs on the Titanic stuff. Overall market and financial scan: Fixed Income: US Treasury Yields are up Corporate bonds are down (yields up) Markets overall: US Equities down Futures today: Up at the open. Europe up. Nikkei up. China stocks down. US Dollar strengthening vs Yen and Euro. 30-year UST up about $0.40 to $139.84 Pre-market trading tends to be more expensive, unless shares are very heavily traded. The spreads tend to be much larger (up to 10% of the share price), and the depth of the top of the book is light. In other words, the best bid / offer is made on 100 shares or less. So, you cannot really trade round lots, and it will be very expensive. It is tough to trade pre-market. There are people doing this at 4am ET and trading these illiquid, short squeeze names. That is very interesting to us. |

Stock Market BLOGJeffrey CohenPresident and Investment Advisor Representative Archives

July 2024

|

RSS Feed

RSS Feed